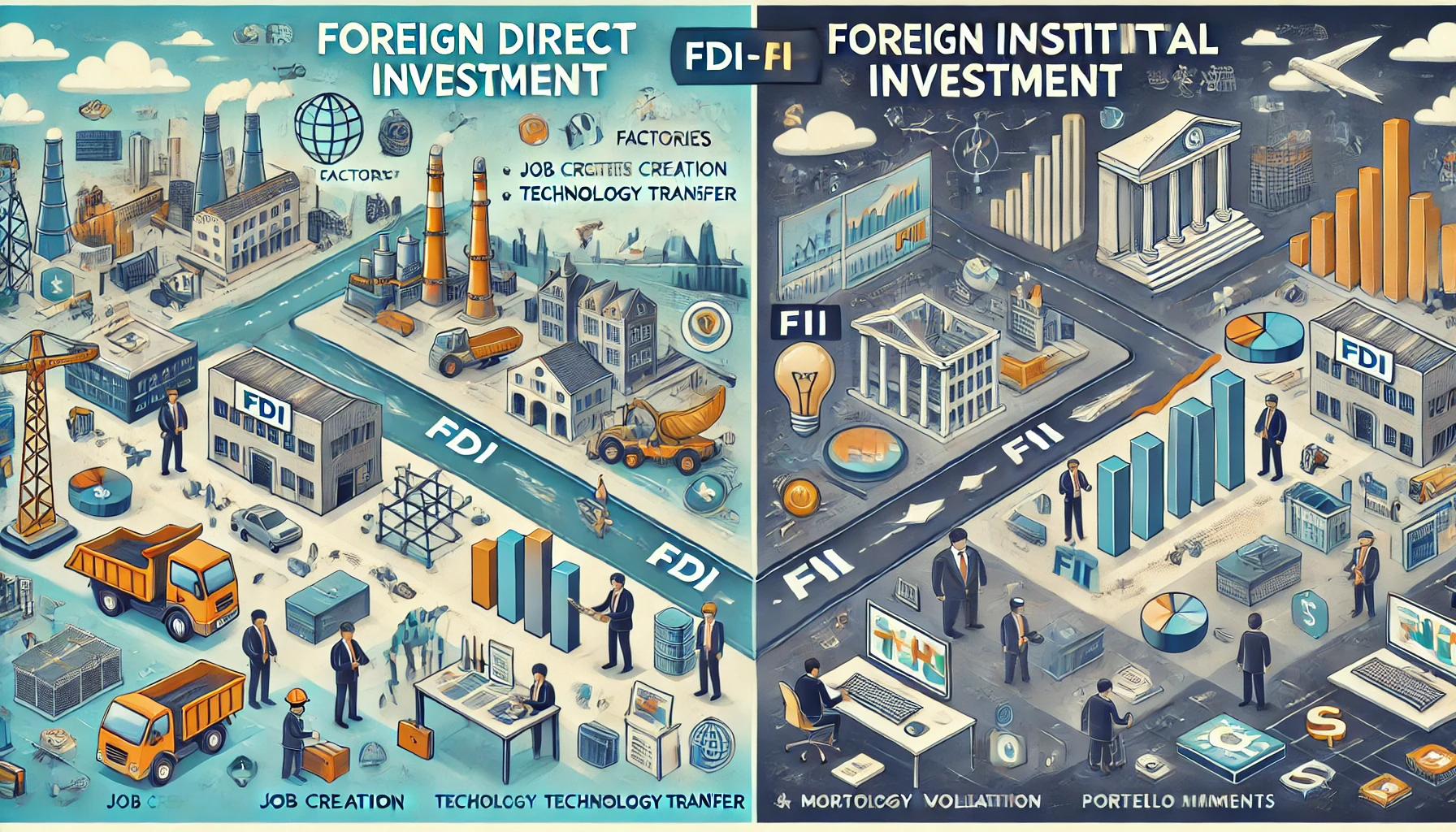

Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII) are both important forms of foreign investment that contribute to the economic development of a country. However, they differ significantly in their nature, objectives, and impact. Here are the key differences between FDI and FII:

| Aspect | Foreign Direct Investment (FDI) | Foreign Institutional Investment (FII) |

| Definition | Investment made by a foreign entity in the physical assets or ownership of a company in another country, typically involving control or significant influence. | Typically long-term, it involves building or acquiring businesses and infrastructure. |

| Nature of Investment | Long-term investment in tangible assets like factories, infrastructure, or business operations. | Short-term investment in financial assets with high liquidity, like stocks and bonds. |

| Control and Management | Involves ownership or significant control over the invested entity, often with active participation in management and operations. | No control or management influence over the entities in which investments are made; primarily focused on portfolio gains. |

| Investment Horizon | The impact is primarily on the financial markets, providing liquidity, increasing market capitalization, and influencing stock prices. | Generally short-term or medium-term, with a focus on quick returns and portfolio diversification. |

| Risk Level | Higher risk due to long-term commitment, involvement in business operations, and exposure to the economic and political environment of the host country. | Lower risk relative to FDI, as investments can be quickly liquidated and are diversified across different financial instruments. |

| Impact on Economy | Significant impact on the real economy through job creation, technology transfer, infrastructure development, and long-term economic growth. | Impact is primarily on the financial markets, providing liquidity, increasing market capitalization, and influencing stock prices. |

| Examples of Investments | Building a factory, acquiring a local company, setting up a joint venture, or expanding business operations in the host country. | Purchasing shares, bonds, mutual funds, or other securities listed on the stock exchanges of the host country. |

| Sectoral Focus | Typically focuses on sectors like manufacturing, services, infrastructure, and technology, with a direct contribution to the host country’s economy. | Focuses on sectors with liquid financial instruments, such as equities, bonds, and other securities, without direct involvement in production or services. |

| Entry and Exit | Entry and exit are more complex due to the need for regulatory approvals, due diligence, and long-term commitments. | Easier entry and exit, as FIIs can move capital quickly in and out of financial markets based on market conditions. |

| Regulatory Environment | Subject to stricter regulations, including approval processes, ownership restrictions, and compliance with local laws. | Generally subject to less stringent regulations, although some countries impose limits on the extent of FII to prevent excessive market volatility. |

| Effect on Currency | FDI can have a stabilizing effect on the local currency, as it involves long-term capital inflows. | FII can lead to greater currency volatility, especially if large amounts of capital are moved in or out of the country quickly. |

| Contribution to Technology Transfer | High, as FDI often involves the transfer of technology, skills, and expertise to the host country. | Low, as FII does not involve direct participation in business operations or technology transfer. |

| Taxation | Taxation on FDI is often more complex, involving corporate taxes, capital gains taxes, and possibly double taxation agreements. | Taxation on FII is generally simpler, focusing on capital gains, dividends, and interest income. |

| Examples | A U.S.-based company building a new manufacturing plant in India (FDI). | A foreign mutual fund purchasing shares of Indian companies listed on the Bombay Stock Exchange (FII). |

Summary of Key Differences

- Nature of Investment:

- FDI involves long-term investments in physical assets and business operations, with significant control over the invested entity.

- FII involves short-term investments in financial assets like stocks and bonds, with no control over the entities.

- Impact on Economy:

- FDI has a direct impact on the real economy by creating jobs, transferring technology, and developing infrastructure.

- FII primarily affects financial markets by providing liquidity, influencing stock prices, and enhancing market capitalization.

- Regulatory Environment:

- FDI is subject to stricter regulations and approval processes due to its long-term nature and involvement in local business operations.

- FII faces fewer regulatory hurdles, with easier entry and exit from financial markets.

- Investment Horizon:

- FDI is long-term, often spanning years or decades.

- FII is short-term, with investments that can be quickly liquidated based on market conditions.

- Risk and Return:

- FDI involves higher risk due to long-term commitment and exposure to local economic and political conditions.

- FII involves lower risk relative to FDI, with more flexibility to adjust the investment portfolio.

Conclusion

Both FDI and FII are crucial for the economic development of a country, but they serve different purposes and have different implications. FDI is more focused on long-term investments in the real economy, bringing in technology, creating jobs, and contributing to sustained economic growth. In contrast, FII plays a key role in enhancing market liquidity, supporting financial market development, and providing capital to businesses through the purchase of financial securities. Understanding the differences between FDI and FII is important for policymakers to create balanced strategies that attract both types of investment while managing their respective risks and benefits.